Germany must undergo an economic policy realignment. The focus must return to strengthening the competitiveness of industry in Germany and Europe.

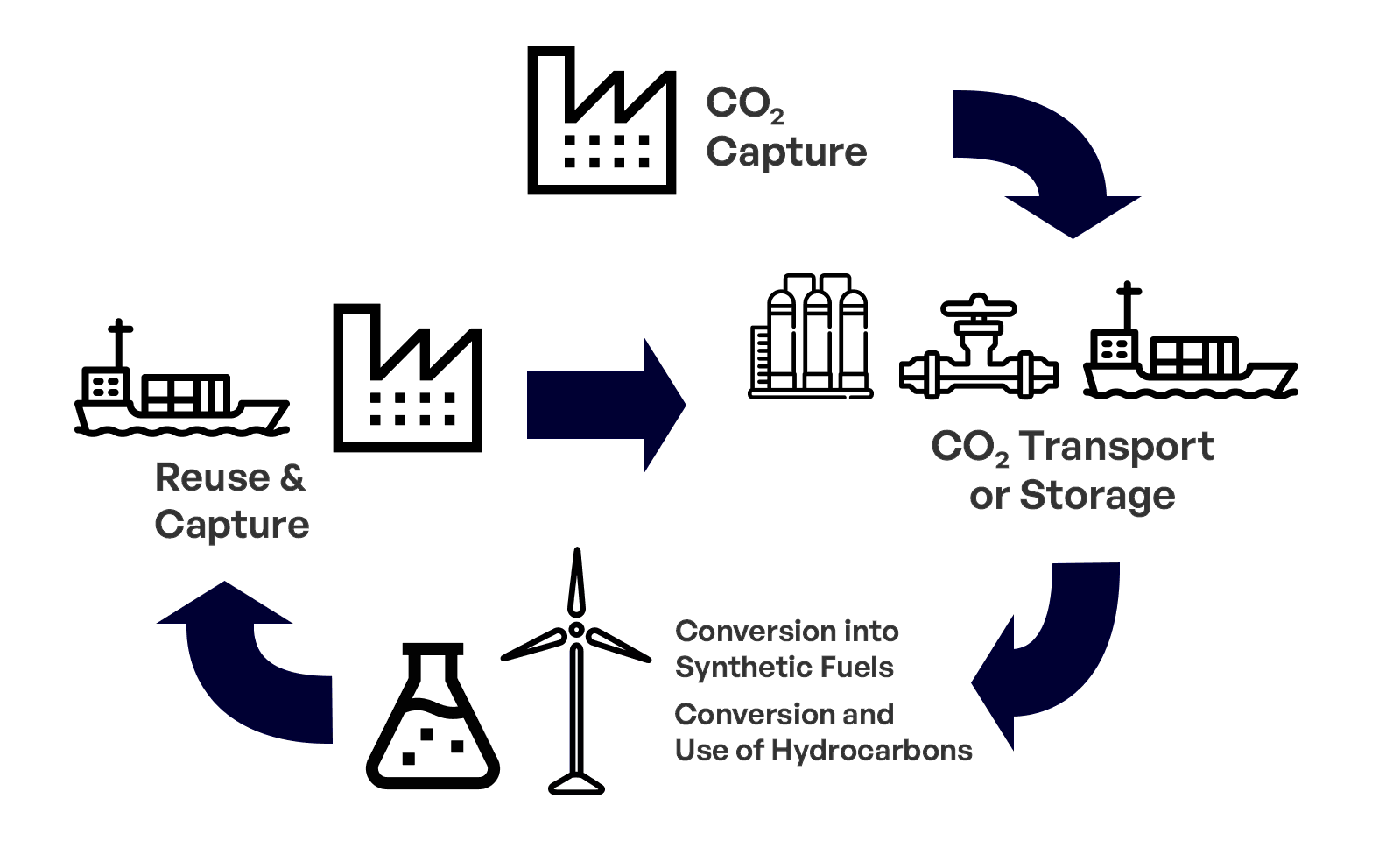

A key lever for this is CCX – Carbon Capture, Utilisation and Storage. Without these technologies, neither the climate targets nor the strengthening of industrial locations can be achieved.

For companies to invest in carbon management technologies, reliable regulatory frameworks are needed.

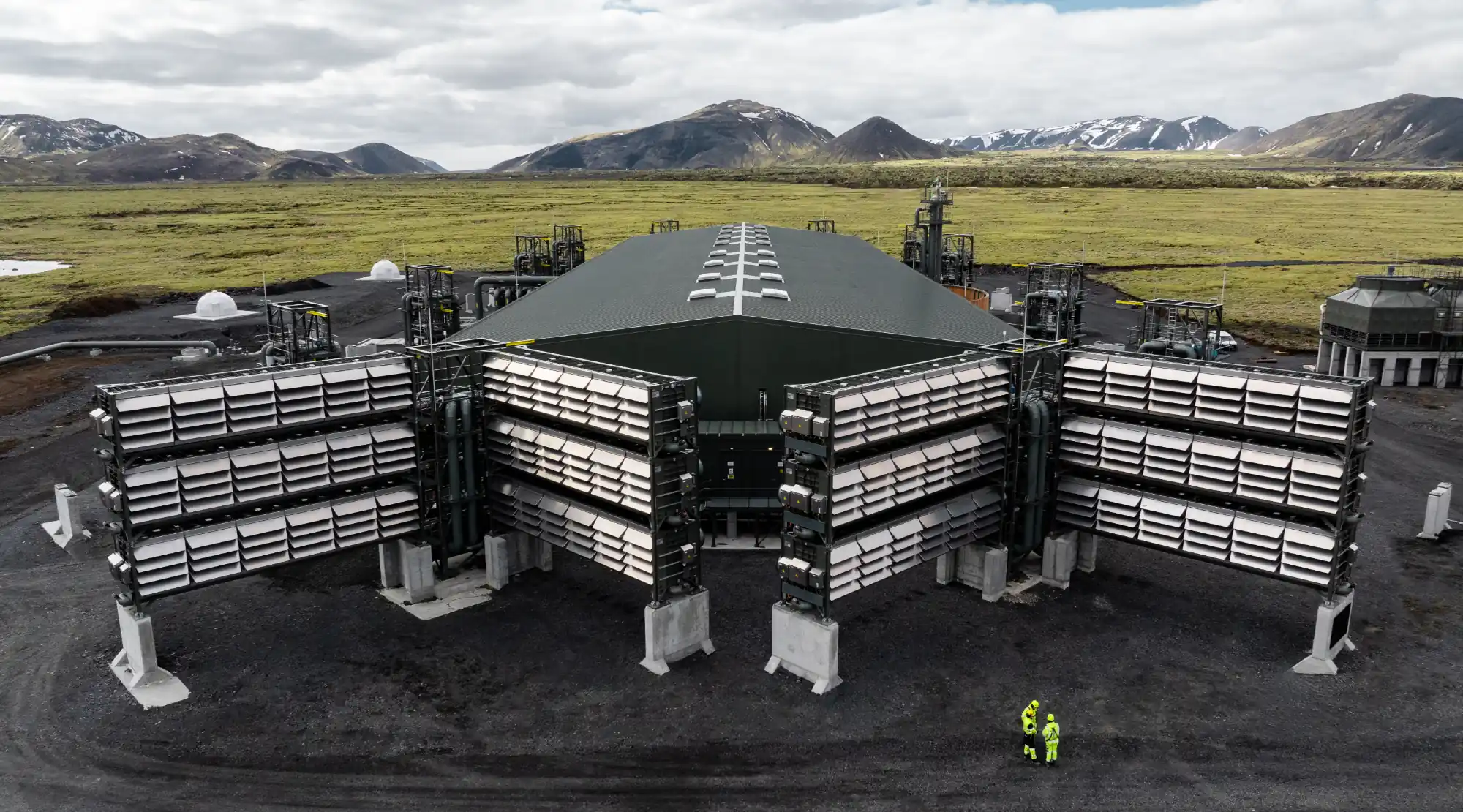

On the demand side, there is already a growing need for CO₂ transport, utilization, and storage services – especially from hard-to-decarbonize sectors such as industry, waste management, and air and maritime transport.

On the supply side, companies in Germany and Europe are among the global technology leaders in CO₂ management. To strengthen this position, clear regulatory requirements are needed. These must also include reducing bureaucracy, accelerating approval processes, and supporting market ramp-up.

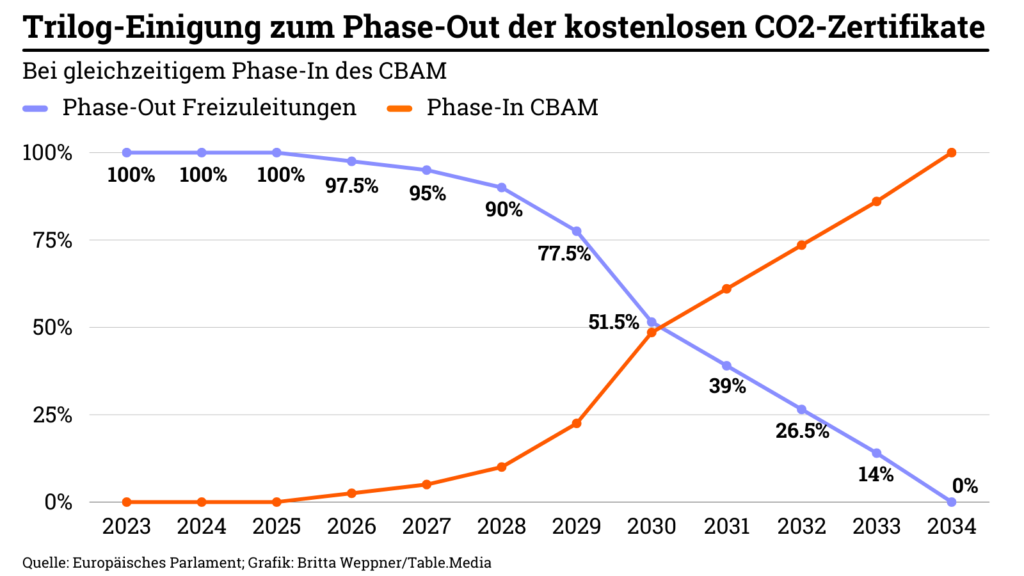

A central lever is the integration of CCU (Carbon Capture and Utilisation) into the EU Emissions Trading System (EU ETS).

So far, industrial companies have received free CO₂ certificates from the EU ETS under certain conditions to cushion competitive disadvantages in the global market. However, by 2030 the number of free certificates will drop significantly, and from 2034 the free allocation will cease entirely for all sectors.

As compensation, companies can access funds from the significantly expanded EU Innovation Fund. However, they must apply, and whether they receive funding is uncertain.

From around 2039, the EU ETS certificate budget will likely be exhausted. CCX creates the conditions to implement these regulatory requirements while maintaining industrial competitiveness.

Additionally, CO₂ capture and utilization form the basis for a CO₂ circular economy – especially in the chemical industry. Carbon-based products remain essential even in a climate-neutral economy, such as in chemicals, industry, or synthetic fuels.

.svg)